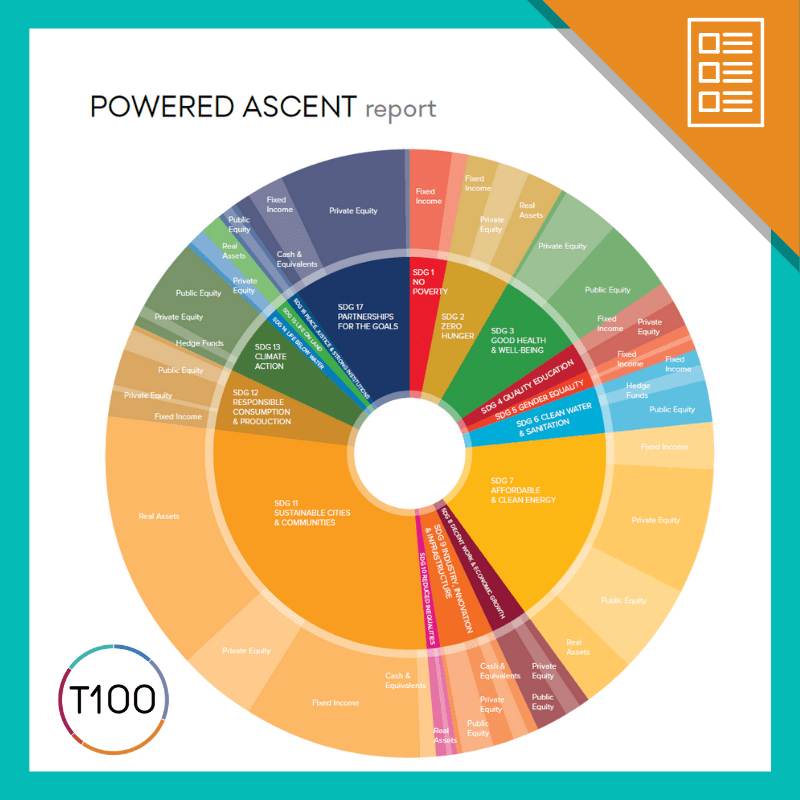

The T100 Project is a longitudinal study of investment portfolios 100% activated towards deeper positive net impact in every asset class. Insights of this research are shared in publicly accessible reports, investor case studies, and a public database of over 1,600 impactful investments.

T100’s mission is to help build the field of impact investing for the public at large through:

- Inspiring investors to build deep impact portfolios across asset classes

- Activating intermediaries to produce more impact products and services

- Empowering the research community with necessary investor data

New from T100

We are pleased to announce Toniic Tracer, a new platform that enables investors, entrepreneurs, and funds to share and compare data about impact investments along with corresponding goals and outcomes.

This is the new core platform for T100. It will allow us to scale the project to more participants, ease the reporting burden, and increase the value of insights.

Reports and Publications

Personal Journeys

Tools

Why T100?

One of the primary reasons impact investors and traditional investors stay on the sidelines is the lack of compelling quantitative and qualitative data points, case studies, and the corresponding lack of impact stories illustrating the viability of impact investing as an approach. In addition, many financial intermediaries do not yet see a business case for the development of impact investing products and services; researchers lack datasets to evaluate behavioral biases and post-modern portfolio theory questions like how impact risk and impact return is related to financial risk and financial return; and there is a general hesitation in the impact industry to share data in a collaborative way.

How to get involved:

If you would like to support the T100 research project and its related data collection and publications, we will thankfully accept your donation. Your donation will support creating awareness and building the impact investing ecosystem.

Become a Toniic member and 100% Network member and add your portfolio to the dataset.

Academic research entities are invited to collaborate with the T100 team to analyze our anonymized dataset and add to the growing body of work about impact investing.

Supporters

We are very grateful for the extraordinary support of the T100 project from the following donors and sponsors:

Academic Partners

On January 16th, 2018 Toniic Institute, the global action community for impact investors, and the Center for Sustainable Finance and Private Wealth (CSP) at the University of Zurich, announced the launch of a partnership to facilitate the study of the investment behavior and motivations of private impact investors. CSP planned to lead a consortium of leading academic researchers who will have access to anonymized data from Toniic members who have committed to “100% impact” investing.

“This partnership is a breakthrough for the study of impact investing,” said Dr. Falko Paetzold, Managing Director of CSP. “This type of data is rarely available for academic study, because it concerns the private wealth of individuals. Wealth managers who have access to such data have neither the permission nor the motivation to share it with academia. Toniic members, who are motivated to improve transparency and build the field, are sending a powerful message by making this data available.”

“We know impact investors have different motivations and thus exhibit different investing behavior than traditional investors, but we don’t understand those differences with precision,” said Dr. Paetzold. “This partnership will facilitate investigation of the drivers of impact investing, the barriers to deployment, the various approaches being taken to impact measurement, and the results being achieved.”

“Our members are leaders in building the field of impact investing,” said Adam Bendell, CEO of Toniic. “Their desire to promote transparency, their trust in us to protect appropriate confidentiality, and our trust in CSP, creates a unique opportunity.”

With their partnership, Toniic and CSP enable for the first time fundamental research in the field of impact investing and private wealth at a level of rigor that only academic study can provide.

Dr. Charly Kleissner, Toniic co-founder and chief strategist of Toniic’s 100% Impact Network, said: “We are thrilled that this research will benefit not only the academic community, but also practitioners. Impact investors are yearning for a “Post-Modern Portfolio Theory” that includes impact at its core, not as a so-called “externality,” as the current antiquated theory of investing does. Deep impact investors are seeking appropriate financial return for the level of impact risk they are willing to take to achieve a targeted level of impact. That is a fundamentally different starting point than traditional asset allocation, and it is not yet guided by rigorous academic research. This partnership promises to change that.”

Anonymized data from the Toniic T100 Project is made available to CSP, who shares it with selected researchers who participate in the academic consortium. Consortium members are empowered to pose questions to Toniic’s wealth holders for inputs into their own research, and in turn shape Toniic’s ongoing data gathering to improve its academic rigor.

“With real-world questions and actual data in hand, the academic community can provide tremendous value to the investing community,” said Prof. Timo Busch, Senior Fellow at CSP and collaboration partner at the University of Hamburg. “This partnership serves as a strong light-house example of the power of collaboration between practitioners and academics. We believe that this collaboration can be a critical turning point in impact investing.”

ABOUT CSP

The Center for Sustainable Finance and Private Wealth (CSP) is a research and teaching unit of the Department of Banking and Finance at University of Zurich. The team of about 12 researchers is focused on academic research, teaching, and the application and uptake of the broad spectrum of sustainable finance solutions in private wealth management. It is funded by private wealth owners and developed out of the Next Gen Impact Investing program launched at the Initiative for Responsible Investment at the Harvard Kennedy School in 2015.

Dr. Falko Paetzold

Director

Falko leads the ARC. He is the Initiator and Managing Director of the Center for Sustainable Finance and Private Wealth (CSP) at the University of Zurich. CSP is a spin-off from the Next Gen Impact Investing program that Falko co-initiated at the Initiative for Responsible Investment at Harvard University. Before CSP, Falko was a fellow at Harvard, a postdoctoral researcher at MIT Sloan, Sustainability Analyst and M&A Consultant at Bank Vontobel, and partner at the sustainable investing consultancy Contrast Capital. Falko founded GreenBuzz, an international network of sustainability intrapreneurs.

Topics of Interest: (impact) investor decision making, role of intermediaries, micro/individual level of decision making

Karim Harji

Karim is a Associate Fellow at Saïd Business School, University of Oxford. Karim is an educator, practitioner, and researcher in impact measurement and impact investing. Karim was the Co-Chair of the Impact Measurement Task Force convened by the Government of Ontario, and a member of the Impact Measurement Working Group of the G8 Social Impact Investment Task Force. Karim was previously Advisor to the Rockefeller Foundation on social impact measurement, and he co-founded the Topical Interest Group on Social Impact Measurement at the American Evaluation Association.

Karim also brings substantive experience as a practitioner in impact investing. He was a co-founder of Purpose Capital (now Rally Assets), the leading impact investment advisory firm in Canada, where he established and led its Impact Advisory practice. He advised investors on the design and implementation of impact investment strategies, and authored widely-cited reports on the trends, challenges, and opportunities in this field. In addition to his roles at Oxford, Karim is a senior fellow with the J.W. McConnell Family Foundation, leading capacity development programming for nonprofits and charities on impact measurement.

Topics of Interest: impact expectations, approaches to measurement, decisions post-reporting

Sebastian Utz

Sebastian is an Assistant Professor at the School of Finance of the University of St. Gallen (HSG). Before he joined HSG in August 2017, he was a post-doctoral research fellow at the University of Regensburg. He received a diploma in mathematics from the University of Augsburg, majoring in Operations Research, Statistics, and Capital Markets and he obtained his PhD in business administration from the University of Regensburg. During his doctoral studies, Sebastian has been recognized with the PhD scholarship of the Konrad-Adenauer-Foundation. In 2014, he spent six months as a visiting research scholar at the Department of Banking and Finance at the Terry School of Business at the University of Georgia in Athens, GA. His focus research areas are sustainable finance and investing, asset pricing, and multi-criteria decision making. His research has been published in journals such as Operations Research (among the Financial Times Top 50 scientific journals), European Journal of Operational Research, Review of Managerial Science, and Review of Financial Economics. Moreover, his research has been honored with the LIFE Climate Foundation Liechtenstein Impact Award and the Shin Research Excellence Award of the Geneva Association, among others.

Topics of Interest: sustainable finance, impact investing

Paul Smeets

Paul is an Associate Professor in Sustainable Finance at Maastricht University. His work focuses on what motivates people to give to charities and to invest not only for financial return but also for social return. He also studies how donors and impact investors can be most effective in creating the largest positive societal impact per euro invested. His work appeared in The New York Times, the Atlantic, Forbes, the Guardian, BBC News, and Süddeutsche Zeitung.

Topics of Interest: motivation of investors to focus on social return next to financial return

Shawn Cole

Shawn is a professor in the Finance Unit at Harvard Business School, where he teaches and conducts research on financial services, social enterprise, and impact investing. Much of his research examines corporate and household finance in emerging markets, with a focus on insurance, credit, and savings. He has also done extensive work on financial education in the US and emerging markets. His recent research focuses on designing and delivering advice and education over mobile phones, with an emphasis on agricultural and financial management.

He is an affiliate of the National Bureau of Economic Research, and the Bureau for Research and Economic Analysis of Development. He is on the board of the Jameel Poverty Action Lab, as the co-chair for research. He is a co-founder and board chair of a non-profit, Precision Agriculture for Development.

Topics of Interest: impact definition and measurement, investor motivation, financial returns

Timo Busch

Timo is a full professor at the School of Business, Economics, and Social Science of University of Hamburg (Germany) and a Senior Fellow at the Center for Sustainable Finance and Private Wealth of University of Zurich (Switzerland). He gives lectures at the Swiss Federal Institute of Technology (ETH) Zurich, and has previously taught at the Duisenberg School of Finance (The Netherlands). He teaches courses on corporate sustainability, business strategy and the environment, and sustainable finance. Timo Busch had several research stays including John Molson School of Business (Canada), Amsterdam Business School (The Netherlands), Nanyang Business School (Singapore), and University of California, Berkeley (USA). He was United Nations delegate at the Rio +20 Conference on Sustainable Development and advises the German government regarding climate change polices. He is a Principal Investigator in the Cluster of Excellence project, Climate, Climatic Change, and Society (CLICCS). Timo is also a member of the editorial board of the journals Organization & Environment, Journal of Business Ethics, and Business Strategy and the Environment.

Before joining the University of Hamburg, he was PhD candidate and postdoctoral researcher at ETH Zürich, and he worked beforehand as a project manager for the Wuppertal Institute for Climate, Environment, and Energy.

Topics of Interest: impact expectations; impacts, risks, and financial performance of impact investments

The T100 Academic Advisory Board advises the Research Consortium on all matters pertaining to the activities of the Research Consortium and T100 research.

The Board is co-chaired by Charly Kleissner and Dr. Falko Paetzold

Dr. Julia Balandina Jaquier, CFA

Julia is an internationally recognized expert in impact investment and a trusted adviser to major families of wealth, international banks, corporates and the Swiss and UK Governments. Over the last 15 years, she has facilitated development of a broad range of mission-driven investment programs. Julia is a Senior Fellow at the Center for Sustainable Finance and Private Wealth at the University of Zurich and a co-founder of the NextGen Impact Leadership Accelerator. She is a member of several (Advisory) Boards and Investment Committees, including at SIFEM (Development Finance Institution of Switzerland), Unilever and FORE. Julia is the author of 2 books on impact investing, she lectures on impact investing at St. Gallen University, IMD, Harvard and CEIBS. Balandina started her career at McKinsey in 1993 and subsequently held senior positions at ABB Financial Services and AIG Global Investment Group, where she managed the AIG’s European direct private equity business, prior to pioneering and leading on the first institutional impact investment funds (2004-’10).

Robert Boogard

Robert has been an entrepreneur all his life, enjoying several successes, but also having had to overcome some failures. He now manages PCG Investments, a single family office dedicating 100% of its resources and returns to social impact, am the founder of Jazi Foundation and the driving force behind ‘Effective Giving’ a group of pioneering large private philanthropists learning together how we can maximize our contribution to a better world.

Paolo Fresia

Paolo is an active impact investor dedicated to generating positive social and environmental impact by committing 100% of his portfolio to investments that are consistent with a clean, fair, and prosperous society. He recently graduated with a Master in Public Policy degree from the Harvard Kennedy School (HKS), where he led the Business & Government student council. Both at HKS and at the International Labor Organization (ILO) in Geneva, Paolo conducted research on policy and FinTech solutions to improve access to finance for rural SMEs in developing countries. Prior to graduate school, Paolo worked as bond trader for Goldman Sachs in London, as CFO for Doctors Without Borders in Haiti, and as corporate sustainability and business and human rights consultant for Business for Social Responsibility (BSR) in Hong Kong. Paolo is a founding member of the Synergy Social Ventures Future Funders investment group, providing venture philanthropy capital to social enterprises across Southeast Asia. He is also a founding sponsor of the Centre for Sustainable Finance and Private Wealth at the University of Zurich, as well as a member of the 100% Network at Toniic. Paolo holds a B.A. in Philosophy and Economics from University College London and an M.Phil. in Development from the University of Cambridge.

Kristin Hull

Kristin is the founder and CEO of Nia Impact Capital, a women-led Registered Investment Advisor leading the charge to change the face of finance by hiring and training women and people of color in sustainable and transformative investing. Kristin founded Nia Global Solutions, a gender-lens portfolio of solutions-focused companies, in her efforts to bring impact investing into the public markets.

An impact Investor since 2007, Kristin oversaw the investment process for one of the first family foundations as they moved their endowment assets into 100% alignment with their philanthropic mission. In 2010 Kristin went on to found Nia Community, a 100% mission-aligned impact investment fund focused on social change and environmental sustainability in her home town of Oakland, California.

Kristin is also a co-founder of Impact Hub Oakland and of the North Oakland Community Charter School, and served on the founding board of George Mark Children’s House. Prior to devoting her career to transforming our financial system, Kristin was a full-time educator, teaching bilingual classes in Oakland and San Francisco. She earned her PhD in Education at University of California, Berkeley, her Masters in Research in Bilingual Education from Stanford University and her BA and teaching credentials from Tufts University.

Veronica Olazabal

Veronica, Senior Advisor & Director of Measurement, Evaluation and Organizational Performance at The Rockefeller Foundation is an award-winning evaluation and data expert with a professional portfolio ranging +15 years, four continents and numerous domestic and international agencies including the MasterCard Foundation and Nuru International.

In addition to serving on a number of funding and advisory boards, Ms. Olazabal serves on the American Evaluation Association’s (AEA) Board of Directors. Recent publications include “Putting the Impact in Impact Investing: The Rising Demand for Data and Evidence of Social Outcomes” in the American Journal of Evaluation, contributing chapter to Salesforce.org’s Impacting Responsibly and “The Free Market Must Account for Environmental and Social Impact” in the Stanford Social Innovation Review (SSIR).

Ruth Shaber, MD

Ruth is the founder and president of the Tara Health Foundation, which promotes health, well-being, and opportunity for women and girls through innovative evidence-informed programs. She started her career as an Obstetrician and Gynecology at the Kaiser Permanente 1990. She served as chief of Obstetrics and Gynecology and director of Women’s Health for the Northern California division of Kaiser Permanente. She is also the founder of the Women’s Health Research Institute in Kaiser Permanente’s Northern California Region. Ruth was the Medical Director at the Kaiser Permanente Care Management Institute (CMI) from 2007 to 2012. She is the chair of the board of directors at Jacaranda Health and on the Medical Advisory Committee for Planned Parenthood Federation of America. Ruth received her B.A. from Yale University and her medical degree from the University of Pennsylvania. She served her residency in Obstetrics and Gynecology at the University of California in San Francisco.

Hersh Shefrin

Hersh is the Mario L. Belotti Professor of Finance at Santa Clara University. He is one of the pioneers in the behavioral approach to economics and finance. The January 2001 issue of CFO magazine lists him among the academic stars of finance. A 2003 article in the American Economic Review listed him as one of the top fifteen economic theorists to have influenced empirical work. In 2009, his behavioral finance book Beyond Greed and Fear was recognized by J.P. Morgan Chase as one of the top ten books published since 2000. Among Professor Shefrin’s other books are A Behavioral Approach to Asset Pricing, Behavioral Corporate Finance, Ending the Management Illusion, Behavioralizing Finance, and Behavioral Risk Management. In addition, he was a contributor to the monograph Solutions for Impact Investors: From Strategy to Implementation. Professor Shefrin received his Ph.D. from the London School of Economics in 1974. He also holds an honorary doctorate from the University of Oulu, Finland. He is frequently interviewed by the press and his work was profiled by BBC-TV in February 2014. He blogs for Forbes, intermittently writes for The Wall Street Journal, The Huffington Post, and VOX, and can be followed on Twitter at @HershShefrin.